BHM, New Bills, Business & Arts Grants

February is such a busy and exciting month! We had the Superbowl, the Winter Olympics, Valentine’s Day and we continue to celebrate Black History Month.

It is also a significant time at the Capitol, bill introductions are finalized, and I have information to share on my new bills SB 972 to support street vendors and SB 1173 to fight climate change.

As COVID-19 conditions continue to improve across California and the Omicron surge subsides, temporary COVID-19 measures the state had put in place have expired. The Governor recently unveiled the state’s SMARTER Plan, the next phase of California’s pandemic response and I have these updates for you.

The Metro I-710 Task Force will develop a Vision and Goals Statement to guide recommendations in the forthcoming I-710 South Corridor Investment Plan, and they want to hear your thoughts!

Several grant opportunities are available, including the California Dream Fund Program, the Downtown Long Beach Alliance Storefront Recovery Grant, and State Arts grants from the California Arts Council. Continue reading to find out more!

Celebrating Black History Month

- This year's theme for Black History Month focuses on the importance of Black Health and Wellness. It was my pleasure to explore this topic in depth with special guest Duke Givens, Founder and CEO of Care Closet LBC, a great organization dedicated to fighting homelessness in Long Beach. In case you missed it, you can watch the event here. While February is almost at a close, let us commit to celebrating and uplifting Black community leaders every day of the year, and to continue to elevate their voices and achievements in our communities.

News from the Capitol

- On February 11, as Ex-Officio Board Member for the California High Speed Rail Authority and as Chair of the Senate Transportation Committee, I was happy to visit a construction site for the nation’s first high-speed rail system to gain a better understanding of the construction progress, hear updates about station area development efforts, sustainability, and economic benefits for local communities throughout the project.

- On February 10, I was proud to introduce SB 972 to support street food vendors—they are a large part of our California economy. This bill would modernize the retail food code to bring vendors into compliance by creating an equitable permitting system while upholding health & safety. Learn more about SB 972 here.

- On February 17, I held a press conference to announce the introduction of my bill SB1173 that would prohibit CalPERS and CalSTRS from investing in fossil fuel companies and require that they divest any current investments by 2027. As a leader in the fight against climate change, California must align the investment choices we make with our moral and environmental goals and SB 1173 will ensure we remain true to our values and honor our commitment as a State to protecting the environment and the health and future of all Californians. Watch the full press conference here and read the latest news coverage on SB 1173 here.

In the District

- On February 8, I was honored to receive the Leadership in Public Service Award from the California Council on Science and Technology (CCST) and to share legislative updates and discuss science in state policy work such as broadband, environmental justice and pandemic response. Thank you CCST for the recognition and your hard work!

- On February 9, I hosted a virtual State Budget Teach-In event in partnership with the California Budget and Policy Center to talk about the Governor’s recently released 2022-23 budget proposal. I was happy to see many of you there and to answer your questions on this very important topic.

- On February 23, I held a Cash for College Webinar to help students and parents learn how to apply for the Free Application for Student Aid (FAFSA), the California Dream Act Application (CADAA) and more financial aid resources. If you missed it, you can watch the webinar in English here, and for Spanish click here.

- On February 24, Team Gonzalez joined the Long Beach Homeless Count, a community-wide effort to count and survey unsheltered people. It is vital for determining the scope of homelessness, defining existing resources available, and identifying gaps. Thank you to the City of Long Beach for organizing this important event!

With COVID-19 Conditions Improving, State Public Health Leaders Modify Omicron Surge Policies

- As COVID-19 conditions continue to improve across California and the Omicron surge subsides, temporary measures the state had put in place have expired.

- Additional visitation requirements that took effect on January 7 for long-term care facilities and hospitals expired on February 7, 2022.

- Definitions for indoor and outdoor mega events returned to pre-surge guidance (from 500 to 1,000 attendees for indoor events, and 5,000 to 10,000 attendees for outdoor events) on February 15, 2022.

- The indoor masking requirement expired February 15 reverting to the previous guidance which requires masking for unvaccinated individuals in all indoor public settings and required masking for all individuals regardless of vaccination status in higher risk settings like public transit and congregate living. Workplaces will continue to follow the COVID-19 prevention standards set by CalOSHA.

The SMARTER Plan - The next phase of California's COVID-19 response

- Governor Gavin Newsom recently unveiled the state’s SMARTER Plan, the next phase of California’s pandemic response. Emphasizing continued readiness, awareness and flexibility, the Plan will ensure California can maintain its focus on communities that continue to be disproportionately impacted and stay prepared to swiftly and effectively respond to emerging COVID-19 variants and changing conditions.

Metro I-710 Task Force Vision & Goals Survey

- The 710 Task Force will develop a Vision and Goals Statement to guide recommendations in the forthcoming I-710 South Corridor Investment Plan, which will be presented to the Metro Board of Directors for consideration in 2023. To ensure this statement reflects the values and priorities of 710 South Corridor communities, they want to hear from you. Please share your thoughts by taking a few minutes to complete the following questionnaire.

- The California Dream Fund Program

- The California Dream Fund Program is a one-time $35 Million grant program that will provide microgrants up to $10,000 to seed entrepreneurship and small business creation in California. This program will be administered by CalOSBA and disbursed through select centers of the California Small Business Technical Assistance Expansion Program (TAEP) Network of Centers.

- Find a participating center near you to start or expand your new small business in California!

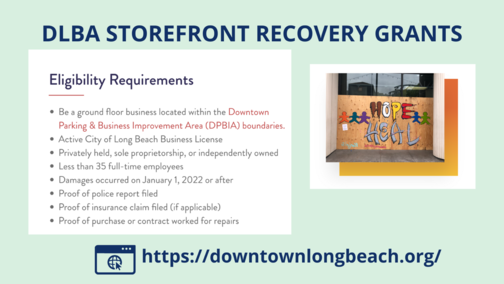

Downtown Long Beach Alliance Storefront Recovery Grant

- The Storefront Recovery Grant provides up to $1,500 in financial relief for the restoration of small businesses impacted by deliberate actions that result in the destruction or damages of small business storefronts. This program will offer amounts of either $800 or $1,500 depending on the total cost incurred to repair physical damages (not including loss of stolen goods or property) and is available on a first-come-first-serve basis, based on fund availability. Businesses can apply for the grant through the DLBA website here.

State Arts Grant Opportunities Available

- Arts grant season is here! 7 grants in Cycle A from the California Arts Council are now open for applications. State Arts grants will support organizational operations, individuals, and project-based activities; prioritizing relief and recovery for organizations and individuals impacted by COVID-19. Learn more at http://arts.ca.gov.

Filing season reminder for teachers: Some educator expenses may be tax deductible

- The educator expense deduction allows eligible teachers and administrators to deduct part of the cost of technology, supplies and training from their taxes. They can only claim this deduction for expenses that were not reimbursed by their employer, a grant or other source.

- Who is an eligible educator? The taxpayer must be a kindergarten through grade 12 teacher, instructor, counselor, principal, or aide. They must also work at least 900 hours a school year in a school that provides elementary or secondary education as determined under state law.

- Things to know about this deduction: Educators can deduct up to $250 of trade or business expenses that were not reimbursed. For more information go to https://go.usa.gov/xtzsN.

Top Social Media Posts

Check out my top social media posts below! Remember to follow me @SenGonzalez33 on FB and Twitter for legislative updates, resources, events and much more!

As always, if you need any other information or assistance, please contact my office at (562) 256-7921 or send us a message here.

Sincerely,

Lena Gonzalez

33rd State Senate District